Ethereum ETFs Outpace Bitcoin Counterparts as Institutions Embrace Smart Contract Ecosystem

Institutional investors are demonstrating a pronounced shift toward Ethereum exposure through ETF channels, with utility-driven blockchain capabilities emerging as a key differentiator in cryptocurrency allocation strategies.

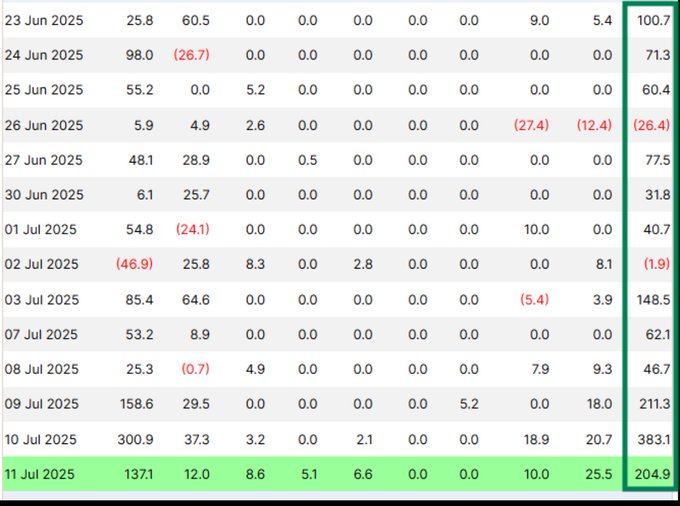

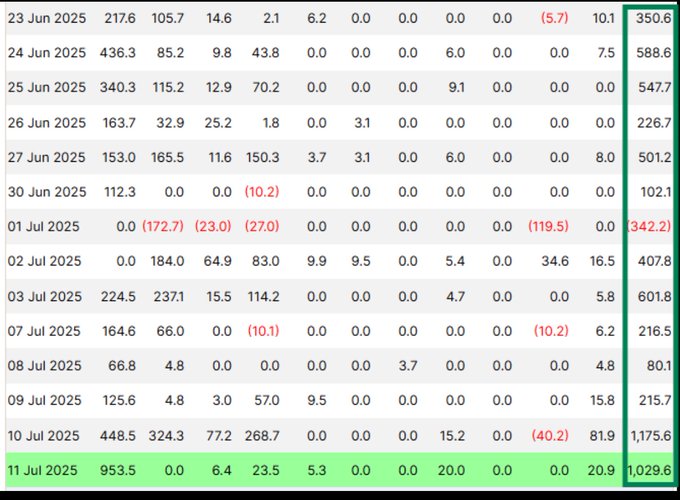

Ethereum ETFs recorded their largest weekly influx since inception with nearly $908 million flowing in over three days (July 9-11), including a record $384 million on July 10 alone.

ETF Flow Dynamics Favor Ethereum

The institutional preference for Ethereum becomes evident in comparative flow data. Early July saw ETH ETF inflows reach $703 million compared to Bitcoin's $448.5 million, marking a significant reversal from Bitcoin's historical dominance in institutional crypto allocation.

Bitcoin ETFs still attracted substantial capital with approximately $2.7 billion in weekly inflows, but Ethereum's momentum suggests institutions are diversifying beyond Bitcoin's store-of-value narrative toward blockchain utility exposure.

Supply Dynamics Create Scarcity

The institutional accumulation has created significant supply pressures. On July 10, U.S.-listed ETFs absorbed 79,000 ETH—representing 34 times the daily issuance of new Ethereum tokens. This dramatic supply-demand imbalance highlights institutional accumulation intensity.

BlackRock's ETHA led major asset managers with $300 million in single-day inflows, now holding over 2 million ETH. Fidelity and Bitwise also contributed significantly to the institutional accumulation trend.

Ethereum Price Response

The institutional demand surge coincided with Ethereum's 17% weekly gain, reclaiming the $3,000 level on July 11 for the first time in months. The price recovery validates institutional confidence in Ethereum's fundamental value proposition beyond speculative trading.

Utility-Driven Investment Thesis

Institutions appear attracted to Ethereum's comprehensive blockchain ecosystem supporting DeFi, smart contracts, staking, and tokenized assets—capabilities absent from Bitcoin's more limited functionality.

The utility-focused approach suggests institutional investors view Ethereum as infrastructure for future financial services rather than solely a digital store of value, differentiating it from Bitcoin's monetary asset positioning.

Ethereum active addresses have surged from 310,000 to 420,000 since May 25, marking a sharp rise in on-chain activity. Glassnode

Staking Integration Catalyst

ETF staking integration, expected by late 2025, could provide additional yield generation capabilities that Bitcoin ETFs cannot offer. This potential income component makes Ethereum ETFs more attractive for institutions seeking both appreciation and yield opportunities.

The staking feature would create sustainable revenue streams while removing technical barriers for institutional investors wanting Ethereum exposure without direct validation participation.

Supply Scarcity Implications

ETF inflows are removing ETH from circulation, potentially creating supply scarcity as institutional demand outpaces network issuance. This dynamic contrasts with Bitcoin's more predictable supply schedule and could drive different price discovery mechanisms.

The 34:1 demand-to-issuance ratio suggests current institutional appetite significantly exceeds Ethereum's inflation rate, creating deflationary pressure on circulating supply.

Coinasity's Analysis

At Coinasity, we view the institutional shift toward Ethereum as validation of utility-based investment strategies beyond Bitcoin's monetary narrative. The $908 million three-day influx demonstrates sophisticated institutional recognition of Ethereum's infrastructure value.

The supply dynamics are particularly compelling. With ETFs absorbing 34 times daily issuance, Ethereum faces structural supply constraints that could support sustained price appreciation independent of broader crypto market sentiment.

Staking integration represents a game-changing catalyst that could permanently differentiate Ethereum ETFs from Bitcoin alternatives. Yield-generating capacity addresses institutional mandates for income production while maintaining crypto exposure.

However, we're monitoring whether this utility-focused allocation represents permanent portfolio strategy evolution or cyclical preference shifts that could reverse during market downturns.

Strategic Implications

The institutional preference for Ethereum suggests cryptocurrency markets are maturing beyond simple risk-on/risk-off dynamics toward fundamental value differentiation. Investors appear increasingly sophisticated in evaluating blockchain utility rather than treating all cryptocurrencies as correlated risk assets.

This evolution could establish Ethereum as the institutional blockchain infrastructure play while Bitcoin maintains its digital gold positioning, creating distinct investment categories within cryptocurrency allocation frameworks.

DISCLAIMER

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve substantial risk and extreme volatility - never invest money you cannot afford to lose completely. The author may hold positions in the cryptocurrencies mentioned, which could bias the presented information. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions.

About Arnas B

Blockchain Researcher & Developer | 8+ Years Crypto Market Experience

Seasoned cryptocurrency researcher and blockchain developer with deep expertise in protocol analysis, smart contract development, and market insights since 2017. Specializes in emerging blockchain technologies, DeFi ecosystems, and cryptocurrency market trends. Combines technical development skills with comprehensive market research to deliver actionable insights for the digital asset space.