Institutional Investors Replace Retail Traders as Market Dynamics Shift Toward Long-Term Allocation

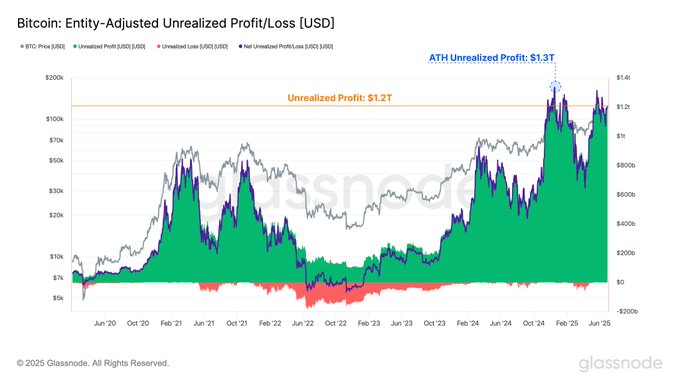

Bitcoin investors are currently holding an estimated $1.2 trillion in unrealized profits, according to on-chain analytics platform Glassnode, highlighting massive paper gains accumulated as Bitcoin continues trading near record highs.

Despite these enormous unrealized gains, market behavior suggests investors are showing remarkable restraint, with no major selling pressure emerging at current elevated price levels.

Profit Per Investor Remains Substantial

Glassnode data reveals that the average unrealized profit per Bitcoin investor stands at approximately 125%. While this figure is lower than the 180% peak reached in March 2024 when Bitcoin hit $73,000, it still represents substantial wealth creation for the Bitcoin community.

At present, the total unrealized profit stands at an estimated $1.2T, underscoring the substantial value appreciation experienced by Bitcoin investors, but also the incentive for potential sell-side pressure that may emerge if sentiment shifts.

Selling Pressure Remains Surprisingly Low

Despite the trillion-dollar profit pool, daily realized profits have remained subdued, averaging just $872 million. This contrasts sharply with previous Bitcoin surges when realized gains reached $2.8 billion to $3.2 billion at price levels of $73,000 and $107,000.

The restrained selling activity suggests a fundamental shift in market participant behavior, with accumulation continuing to outweigh distribution pressures.

Institutional Transformation of Bitcoin Holdings

Bitcoin analyst Rezo identified a fundamental shift in the Bitcoin holder profile, noting the transition from short-term speculative traders to long-term institutional investors.

"The holder base has changed – from traders seeking exit to allocators seeking exposure," Rezo observed, pointing to increasing influence of ETFs and companies like MicroStrategy.

Public companies increased Bitcoin holdings by 18% in Q2, while ETF exposure climbed 8% during the same period. MicroStrategy exemplifies this behavior by continuing to accumulate despite sitting on tens of billions in unrealized gains.

Market Structure Evolution

Glassnode's analysis shows "HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures."

Rezo suggests most short-term sellers exited between $70,000 and $100,000, leaving investors who treat Bitcoin as strategic long-term allocation rather than speculative trades.

Coinasity's Market Analysis

At Coinasity, we view the $1.2 trillion unrealized gain pool as testament to Bitcoin's evolution from speculative asset to institutional treasury holding. The restrained selling behavior despite massive profits suggests holders view current prices as below long-term fair value.

The 18% corporate accumulation increase and 8% ETF growth indicates institutional conviction beyond retail HODL culture. This dynamic could create supply shock conditions as strong holding behavior meets continued institutional demand.

The shift from traders to allocators means traditional technical analysis may be less relevant when your holder base consists of corporate treasuries and ETFs with multi-year mandates.

Supply Shock Potential

With $1.2 trillion in unrealized gains remaining largely untouched and institutional accumulation continuing, Bitcoin may be building toward supply shock conditions. The reluctance to sell combined with ongoing ETF and corporate demand could create sustained upward pressure.

This transformation suggests Bitcoin's price discovery mechanism has fundamentally changed, potentially leading to different volatility patterns and reduced selling pressure during price appreciation phases.

DISCLAIMER

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve substantial risk and extreme volatility - never invest money you cannot afford to lose completely. The author may hold positions in the cryptocurrencies mentioned, which could bias the presented information. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions.

About Arnas B

Blockchain Researcher & Developer | 8+ Years Crypto Market Experience

Seasoned cryptocurrency researcher and blockchain developer with deep expertise in protocol analysis, smart contract development, and market insights since 2017. Specializes in emerging blockchain technologies, DeFi ecosystems, and cryptocurrency market trends. Combines technical development skills with comprehensive market research to deliver actionable insights for the digital asset space.