Mysterious Movement of 14-Year-Old Satoshi-Era Bitcoin Raises Security Concerns

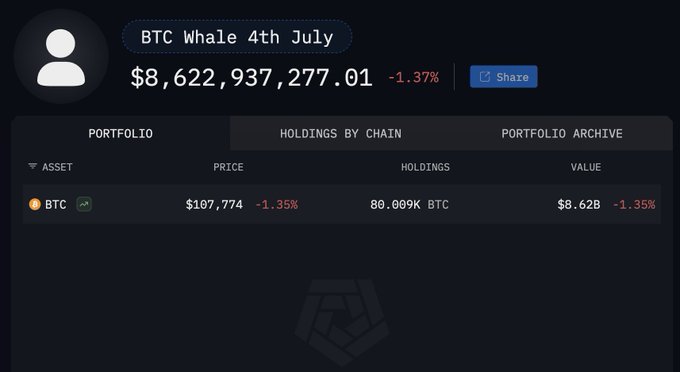

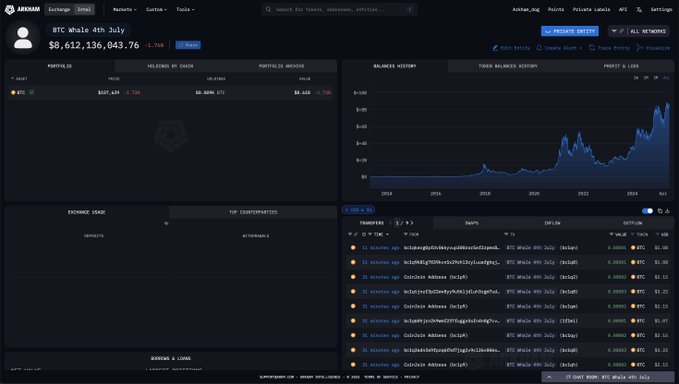

A massive $8.6 billion Bitcoin transfer from dormant Satoshi-era wallets has sparked concerns from a top cryptocurrency executive that the movement could represent the largest crypto hack in history.

Conor Grogan, director at Coinbase, America's largest cryptocurrency exchange, raised alarm bells about the mysterious transfer of 80,000 Bitcoin from eight addresses that had remained untouched for over 14 years.

Suspicious Testing Transaction Raises Red Flags

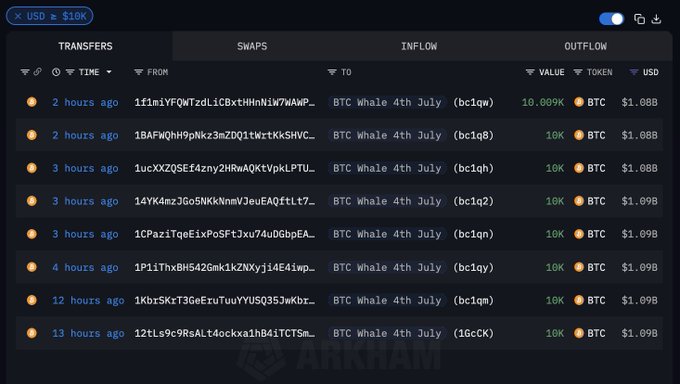

Grogan's concerns center on a suspicious Bitcoin Cash (BCH) transaction that preceded the massive Bitcoin movements. Before the main transfers began, someone moved over 10,000 BCH tokens (valued at approximately $5 million) from one of the associated addresses.

"There is a small possibility that the $8B in BTC that recently woke up were hacked or compromised private keys," Grogan observed in a detailed analysis posted on Twitter. The BCH transaction particularly caught his attention as a potential testing mechanism.

A single entity moved $8.6 BILLION of BTC from 8 addresses in the past day. All of the Bitcoin was moved into the original wallets on either 2nd April or 4th May 2011 and has been held for over 14 years. Currently, the Bitcoin is sitting in 8 new addresses and has not been Show more

Market Impact and Selling Pressure Concerns

Historically, massive movements from dormant OG wallets often signal impending selling pressure as early Bitcoin holders liquidate their positions. However, this case presents an unusual twist: the Bitcoin remains in the eight new destination wallets and hasn't been deposited into exchange addresses.

This pattern differs from typical large-scale liquidations, where coins are quickly moved to exchanges for sale. The lack of exchange deposits could support either the hacking theory—where perpetrators may be unsure how to safely liquidate such a massive amount—or suggest the legitimate owner has different intentions.

Bitcoin Price Stability Despite Uncertainty

Despite the massive transfer and hacking speculation, Bitcoin's price has remained relatively stable. The cryptocurrency was trading at $108,029 according to CoinGecko data, showing minimal movement over the 24-hour period following the transfer.

Bitcoin currently sits approximately 3.4% below its lifetime high of $111,814 reached in May, suggesting the market either doesn't believe the hacking theory or isn't concerned about immediate selling pressure.

Technical Security Implications

If Grogan's theory proves correct, this incident would represent a significant security breach with far-reaching implications for the cryptocurrency industry. Compromised Satoshi-era private keys would raise questions about the long-term security of dormant Bitcoin holdings and the methods used to access legacy wallets.

The selective access pattern—where BCH was moved but other associated assets weren't—suggests sophisticated technical knowledge combined with potentially limited access, characteristic of certain types of cryptographic attacks.

Coinasity's Analysis

At Coinasity, we find Grogan's analysis compelling, particularly the behavioral anomalies he identified. The pre-transfer BCH testing and selective wallet access are indeed suspicious patterns that warrant serious investigation.

However, we're also considering alternative explanations. A legitimate owner recovering old wallets might exhibit similar testing behavior, especially when dealing with such massive amounts. The 14-year dormancy could also explain cautious, incremental access to different assets.

What concerns us most is the potential precedent this could set. If Satoshi-era wallets can be compromised, it raises questions about the security of other early Bitcoin holdings and could impact long-term market confidence.

We're watching for exchange deposits as the key indicator. If these funds start moving to trading platforms, it could trigger significant market volatility regardless of whether it's a hack or legitimate sale.

Ongoing Investigation and Monitoring

The cryptocurrency community continues monitoring these wallets closely for any further movement or attempts to liquidate the holdings. Blockchain analysis firms are conducting detailed investigations to determine the legitimacy of the transfers.

Law enforcement agencies may also be investigating given the scale of the potential theft and the sophisticated methods that would be required to compromise Satoshi-era private keys.

The outcome of this investigation could have significant implications for Bitcoin's security narrative and the broader cryptocurrency market's confidence in long-term holdings.

DISCLAIMER

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve substantial risk and extreme volatility - never invest money you cannot afford to lose completely. The author may hold positions in the cryptocurrencies mentioned, which could bias the presented information. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions.

About Arnas B

Blockchain Researcher & Developer | 8+ Years Crypto Market Experience

Seasoned cryptocurrency researcher and blockchain developer with deep expertise in protocol analysis, smart contract development, and market insights since 2017. Specializes in emerging blockchain technologies, DeFi ecosystems, and cryptocurrency market trends. Combines technical development skills with comprehensive market research to deliver actionable insights for the digital asset space.