Massive Transfer from "80K Whale" Sparks Market Speculation as Bitcoin Retreats from $123,200 High

A mysterious Satoshi-era whale known as the "80K whale" has transferred 40,000 Bitcoin to Galaxy Digital, raising questions about potential institutional selling as Bitcoin retreats from its recent all-time high of $123,200.

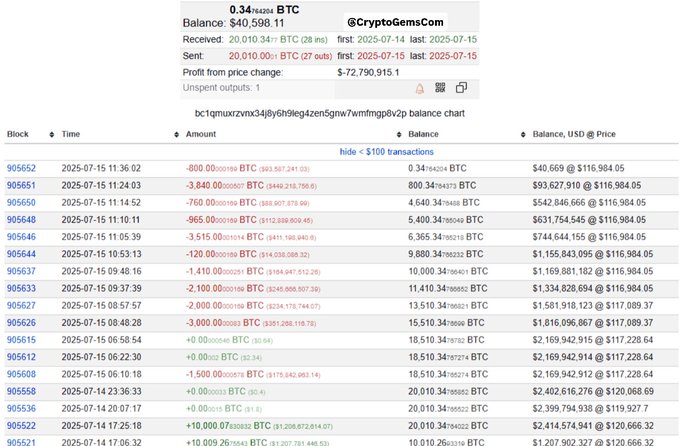

The transfer, flagged by analyst Darkfost, originated from wallet address bc1qmuxrzvnx34j8y6h9leg4zen5gnw7wmfmgp8v2p, which is now completely empty. The wallet cluster is believed to hold over 80,000 BTC from Bitcoin's earliest days.

🚨Big Whale, who holds 80K #Bitcoin, split 40K #BTC into two separate wallets yesterday, each holding 20K BTC. The sale of all 40K Bitcoin to #GalaxyDigital was completed immediately. There's still a remaining 40K BTC in four separate wallets, totaling 10K. I'll share it if Show more

Galaxy Digital's Role and KYC Implications

The transfer to Galaxy Digital, a major institutional crypto firm, is particularly significant because the company enforces strict Know Your Customer (KYC) protocols. This suggests that the whale's identity is now known to Galaxy Digital, marking a rare instance of early Bitcoin holder identification.

The move could indicate several possibilities: preparation for OTC (Over-the-Counter) selling through Galaxy's brokerage desk, institutional asset management services, or yield generation strategies for previously dormant Bitcoin holdings.

Remaining Holdings and Market Impact

Four other wallets from the same cluster still collectively hold 40,000 BTC that haven't moved yet, according to Darkfost's analysis. This means the total selling pressure from this whale cluster remains uncertain, with potentially another 40,000 Bitcoin available for future transactions.

The timing is notable, coming just after Bitcoin reached its $123,200 all-time high before retreating to approximately $116,500—a 6% decline that coincided with increased selling volume.

Bitcoin Price Action and Technical Analysis

Bitcoin's retreat from the ATH shows signs of profit-taking activity and institutional selling pressure. The cryptocurrency currently trades around $116,509, representing significant selling pressure following the record high.

Despite the pullback, Bitcoin maintains support above key moving averages: the 50 SMA ($109,353), 100 SMA ($107,729), and 200 SMA ($101,375). These levels continue trending upward, indicating the longer-term trend remains intact.

The $114,000–$117,000 range now serves as short-term support, aligning with previous consolidation areas. A breakdown below this level could trigger a retest of $109,300 support, while recovery above $119,000 would suggest renewed buying interest.

Market Context and Institutional Interest

Despite the whale movement and price retreat, Bitcoin's fundamentals remain strong. Supply on exchanges continues at historically low levels, and long-term holders show no signs of mass distribution, suggesting the recent selling pressure may be isolated rather than indicative of broader market sentiment shifts.

Institutional interest continues growing across multiple sectors, with Galaxy Digital itself representing the type of professional infrastructure that enables large-scale Bitcoin transactions without significant market disruption.

Historical Significance of Satoshi-Era Movements

Movements from Satoshi-era wallets (2009-2011) always generate significant attention because these Bitcoin holdings represent some of the earliest mined coins. The "80K whale" cluster is particularly notable for its size and the fact that these coins have remained largely dormant for over a decade.

The transfer to an institutional platform like Galaxy Digital marks a potential shift from long-term holding to active management, which could indicate changing strategies among early Bitcoin adopters.

Selling Pressure Analysis

Darkfost noted that selling activity appears ongoing, though the exact amount being liquidated versus repositioned for yield generation remains unclear. The strict KYC requirements at Galaxy Digital suggest professional handling rather than immediate market dumping.

Large-scale whale movements often trigger market concerns, but historical data shows that institutional OTC transactions typically minimize immediate price impact compared to exchange-based selling.

Coinasity's Take

At Coinasity, we view this whale movement as significant but not necessarily bearish for Bitcoin's long-term outlook. The transfer to Galaxy Digital suggests professional management rather than panic selling, given the firm's institutional focus and OTC capabilities.

The 40,000 BTC transfer represents substantial volume, but Bitcoin's ability to maintain support above key moving averages during the retreat shows underlying market strength. The fact that another 40,000 BTC remains in related wallets creates uncertainty but also suggests measured rather than rushed selling.

Institutional infrastructure like Galaxy Digital's OTC desk is designed to handle large transactions without major market disruption, which could explain Bitcoin's relatively controlled retreat despite the massive transfer.

However, we're monitoring whether the remaining 40,000 BTC in related wallets will follow similar patterns, as coordinated selling from the entire cluster could create more significant price pressure.

Market Structure Implications

The whale's choice to use Galaxy Digital rather than direct exchange deposits suggests sophistication in execution strategy. Institutional OTC desks typically offer better pricing for large transactions while minimizing market impact through careful order management.

This development highlights Bitcoin's evolution from early adopter holdings to institutional asset management, where even Satoshi-era coins are being integrated into professional financial infrastructure.

Outlook and Monitoring Points

Key factors to watch include movements from the remaining 40,000 BTC in related wallets, Bitcoin's ability to hold the $114,000-$117,000 support range, and any additional large institutional transfers that might indicate broader early adopter selling.

The market's reaction to this whale activity will likely influence how other large holders approach potential liquidation or repositioning strategies, making this a significant test of Bitcoin's institutional market depth and maturity.

DISCLAIMER

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve substantial risk and extreme volatility - never invest money you cannot afford to lose completely. The author may hold positions in the cryptocurrencies mentioned, which could bias the presented information. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions.

About Arnas B

Blockchain Researcher & Developer | 8+ Years Crypto Market Experience

Seasoned cryptocurrency researcher and blockchain developer with deep expertise in protocol analysis, smart contract development, and market insights since 2017. Specializes in emerging blockchain technologies, DeFi ecosystems, and cryptocurrency market trends. Combines technical development skills with comprehensive market research to deliver actionable insights for the digital asset space.