From Prison Cells to Ongoing Trials: The Current Status of 2022's Most Notorious Figures

Three years after the devastating 2022 crypto winter that wiped out trillions in market value and brought the industry to its knees, many of the key figures responsible for the chaos remain behind bars, facing trials, or dealing with the lasting consequences of their actions.

The notorious bear market wasn't just the result of broader economic pressures like inflation and rising interest rates. Specific catastrophic events within the crypto ecosystem—including the FTX collapse, Terra-Luna implosion, Three Arrows Capital default, and widespread lending platform bankruptcies—created a perfect storm that nearly destroyed the industry.

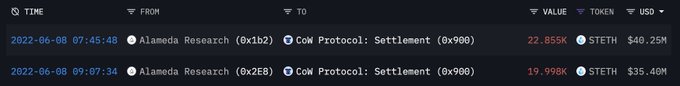

Figured I'd dust off some lesser known facts about SBF given today is his sentencing 🧵 1. In January '22, Sam market sold $75M of stETH, leading to a massive depeg event which set off the Celsius bankrun and the daisy chain of events that included the blow-up of 3AC

Caroline Ellison: Cooperating From Prison

Caroline Ellison, former CEO of Alameda Research and SBF's former girlfriend, is serving a two-year sentence at a low-security federal prison in Connecticut since November 2024. Her significantly reduced sentence reflects her extensive cooperation with authorities, including pivotal testimony against Bankman-Fried during his trial.

Alameda Research, the primary destination for misused FTX customer funds, filed for bankruptcy in 2022 and is no longer operational. Its remaining assets are part of the broader FTX liquidation process.

Do Kwon: Awaiting His Day in Court

Do Kwon, co-founder of Terraform Labs, remains in legal limbo following his December 2024 extradition to the United States. The collapse of his TerraUSD stablecoin and Luna token in May 2022 wiped an estimated $40-60 billion from the crypto market within days.

After his arrest in Montenegro in March 2023 for using falsified documents, Kwon now faces multiple federal felony charges including securities fraud, commodities fraud, wire fraud, conspiracy, and money laundering. He has pleaded not guilty to all charges, with his criminal trial scheduled for January 2026.

The SEC has already found Kwon and Terraform Labs liable for civil fraud, reaching a settlement that includes substantial financial penalties and effectively bans Kwon from the securities industry. Meanwhile, Terraform Labs filed for bankruptcy in January 2024 and is currently undergoing liquidation.

LUNA - THE BIGGEST CRYPTO SCAM IN HISTORY. $40 billion lost in 1 day. The untold story of what happened 🧵 1/14

Alex Mashinsky: Celsius's False Promises

Alex Mashinsky, former CEO of Celsius Network, is serving a 12-year federal prison sentence after pleading guilty to commodities and securities fraud in May 2024. His sentence includes three years of supervised release, a $50,000 fine, and forfeiture of $48.4 million in illegal proceeds.

Celsius promised impossibly high interest rates on crypto deposits while engaging in risky, undisclosed investments and uncollateralized loans. Mashinsky was also accused of artificially inflating Celsius's CEL token price and profiting from insider sales.

When the crypto market collapsed in mid-2022, Celsius froze all customer withdrawals on June 12, trapping billions of dollars. The platform filed for bankruptcy a month later, deepening the crypto winter's impact.

Celsius has since emerged from bankruptcy and begun distributing over $3 billion to creditors, who now jointly own a new Bitcoin mining company, Ionic Digital, Inc. The company is also pursuing a $4 billion lawsuit against Tether for alleged improper liquidation of Bitcoin collateral.

Su Zhu and Kyle Davies: Still on the Run

Su Zhu and Kyle Davies, co-founders of the once-mighty Three Arrows Capital (3AC), remain largely embroiled in legal disputes with mixed outcomes.

Zhu was arrested in Singapore in September 2023 for contempt of court and served a four-month prison sentence before being released. Davies has largely evaded liquidators and remains at large. Both founders face nine-year bans from Singapore's financial regulator.

3AC's aggressive, highly leveraged trading strategies and massive exposure to the Terra ecosystem proved catastrophic. When TerraUSD collapsed and Luna crashed in May 2022, 3AC suffered devastating losses and failed margin calls from numerous lenders.

The fund's insolvency and subsequent liquidation in June 2022 created a massive contagion effect, causing severe distress for crypto lending platforms that had lent heavily to 3AC. This domino effect cemented 3AC's role as a primary catalyst for the 2022 crypto winter.

3AC remains under liquidation with court-appointed liquidators working to recover assets for creditors who filed over $3.5 billion in claims.

Industry Recovery and Lessons Learned

While the crypto industry has achieved a remarkable recovery since 2022—with Bitcoin reaching new all-time highs and institutional adoption accelerating—the consequences for those responsible continue unfolding.

The bankruptcies, prison sentences, and ongoing legal proceedings serve as stark reminders of the devastation caused by reckless behavior, fraudulent activities, and overleveraged positions that characterized the 2022 collapse.

Coinasity's Perspective

At Coinasity, we view the ongoing legal consequences as necessary for the industry's long-term credibility. The fact that major figures like SBF, Mashinsky, and others are facing serious prison time sends a clear message that crypto isn't a lawless frontier where fraud goes unpunished.

The successful FTX bankruptcy proceedings, in particular, demonstrate that even in catastrophic failures, proper legal processes can recover significant value for victims. This builds confidence in the industry's ability to handle crises responsibly.

However, we're watching the Do Kwon trial closely. The Terra-Luna collapse was arguably the most technically complex fraud case, involving algorithmic stablecoins and market manipulation. The outcome could set important precedents for future DeFi-related prosecutions.

The industry has clearly moved past the crypto winter, but these ongoing legal proceedings ensure that the lessons learned from 2022's disasters won't be forgotten. As we enter a new bull market cycle, the memory of these consequences should serve as a deterrent to future bad actors.

Looking Forward

As the crypto industry continues its remarkable recovery, the fate of these figures serves as both a cautionary tale and a sign of the market's maturation. The successful prosecution and imprisonment of major bad actors demonstrates that cryptocurrency markets are not beyond the reach of traditional legal systems.

The ongoing trials and appeals will continue to unfold throughout 2025 and 2026, providing closure for victims while establishing important legal precedents for the industry's future governance and accountability standards.

This story is based on publicly available information, including trial records, regulatory filings, and previously reported events.

Inspired by reporting from BeInCrypto.

DISCLAIMER

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments involve substantial risk and extreme volatility - never invest money you cannot afford to lose completely. The author may hold positions in the cryptocurrencies mentioned, which could bias the presented information. Always conduct your own research and consider consulting a qualified financial advisor before making any investment decisions.

About Arnas B

Blockchain Researcher & Developer | 8+ Years Crypto Market Experience

Seasoned cryptocurrency researcher and blockchain developer with deep expertise in protocol analysis, smart contract development, and market insights since 2017. Specializes in emerging blockchain technologies, DeFi ecosystems, and cryptocurrency market trends. Combines technical development skills with comprehensive market research to deliver actionable insights for the digital asset space.

Follow on X (Twitter)